Shared ownership mortgage how much can i borrow

Shared ownership is only available to first-time buyers those whove previously owned a home but cant afford to buy one now and existing shared ownership homeowners who want to move house. Shared Ownership Wales.

A Collection Of Latin Maxims And Phrases Literally Translated Intended For The Use Of Students For All Legal Examinations Cotterell John Nicholas Free Do Latin Maxims Maxim Phrase

Of course this depends on both parties circumstances and the addition of an applicant with very little or no income.

. As of April 2021 changes to shared ownership schemes were introduced under the governments Affordable Homes Programme including. For more information see the Shared Ownership Wales website. Please get in touch over the phone or visit us in branch.

Shared ownership is a type of mortgage. Up to 75 and a 575 mortgage where the borrower could borrow up. 754 Leaseholders wishing to borrow.

London Help to Buy loans are available on new-build properties worth up to. Rent is paid on the un-owned share of the property. You could consider taking out life or life and critical illness insurance alongside your mortgage.

Choose a shared ownership home loan designed to help you get into a home of your own sooner. The market you can use the Share to Buy Mortgage Affordability Calculator to determine how much you may be able to borrow and the Share to Buy. For more information about mortgage default on Shared Ownership.

There are extra costs when buying a home including solicitors fees and mortgage arrangement fees. Theres a good chance you will refinance again or sell your home in the next 625 years. If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator.

Our mortgage eligibility guide covers what mortgage lenders look for when deciding how much you can borrow. You pay rent on the rest. Thats where shared ownership mortgages can help.

In a few exceptional cases you might be able to borrow as much as 6 times your annual income. Please call us to discuss. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Shared Ownership just with a non-branded name. If youre a first time buyer saving a big deposit can be tricky. Lenders mortgage insurance LMI can be expensive.

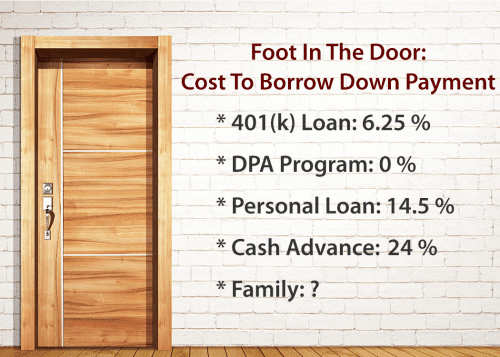

Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar. A break-even period of 25 months is fine and 50 might be too but 75 months is too long. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

Your loved ones would receive a lump-sum payment if you died and depending on your cover could receive a lump sum if you were diagnosed with a critical illness. The cosigner has no right to the property but guarantees they will pay the loan if the primary borrower defaults. Before you can apply for a shared ownership mortgage youll need to contact your local housing association to find out if the scheme is available in your area and if youre eligible to apply.

The amount of your deposit and how much you can set aside for monthly mortgage payments. As of December 2020 the average home price in the UK was 251500. With our Retirement Interest Only Mortgage calculator you can find out how much you could be eligible to borrow in just a few minutes.

Joint loan Borrowers take out the loan together and jointly own the property the loan pays for. Shared ownership mortgage calculator. Shared Ownership properties can often be found in private developments as a certain number of Shared Ownership homes will often be required as a part of the planning permission for a development.

Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage balance until it. Both Cosigners and joint borrowers are 100 responsible for the loan including the. And it doesnt matter if youre single or a couple your household income must be less than 80000 a year 90000 if you live in London.

A 0 mortgage where the borrower could borrow up to 25 of the value of property and give up appreciation worth three times the percentage borrowed ie. Cosigning One borrower takes out the loan and owns the property it pays for. Speak to a mortgage broker to find out how your situation could affect how much mortgage you can borrow.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own.

You can use your first home owner grant FHOG towards your deposit if you build. This guide sets out how the scheme works in England who can take part and. No lenders mortgage insurance.

351 Owner occupiers can access Shared Ownership subject to the following conditions. Its different to a residential mortgage as instead of buying the whole property you buy a share. Mortgage loan basics Basic concepts and legal regulation.

Shared ownership what were referring to on this website The same as Help to Buy. A shared appreciation mortgage or SAM is a mortgage in which the lender agrees to receive some or all of the repayment in. How much mortgage can you borrow on your salary.

Housing Authority co-own a share of the property with you lowering your loan amount. How much do houses cost. You can apply if youre a first-time buyer a previous homeowner who can no longer afford a mainstream mortgage or already live in a shared ownership home and want to move.

You can borrow the remaining 55 from a commercial mortgage lender. Shared Ownership Wales allows 25 to 75 of a housing association home to be bought by those unable to obtain the level of mortgage needed to buy a home outright. Changes to shared ownership schemes.

These covers are designed to offer some financial protection against the unexpected. Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive. Deposit from as low as 2.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income. Your household income must be less than 80000 if you live outside London or 90000 if youre living in London. Shared Ownership is an affordable way to buy a property where you purchase a share of a house that suits you.

This typically costs about 1000. You buy a share usually 25-75. When you buy a shared ownership home you buy between 25 and 75 of its value and pay rent on the rest.

Youll pay a mortgage on your share then pay rent on the rest. You buy a share usually 25-75. How much can you borrow.

A Retirement Interest Only Mortgage is available to people over 55 and is a loan secured against the value of your home. The amount you are able to borrow will help you determine the size. You only pay a mortgage and deposit on the share you own.

How Do Lenders Know If You Borrow Your Down Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Borrowing Power Calculator Sente Mortgage

What Is A Reverse Mortgage Money Money

Pin On Housing Market

How A Change In Mortgage Rate Impacts Your Homebuying Budget Mortgage Rates Budgeting Mortgage

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Mortgage Affordability Calculator Trulia

Appraisals Are Closing In On Estimates By Homeowners Just 0 36 Percent Below What Was Expected According To The March Quicken Appraisal Perception Homeowner

Cristina Ferrara On Instagram Mortgage Interest Rates Have Dropped Considerably Over The Past Year Locking A Mortgage Interest Rates Interest Rates Mortgage

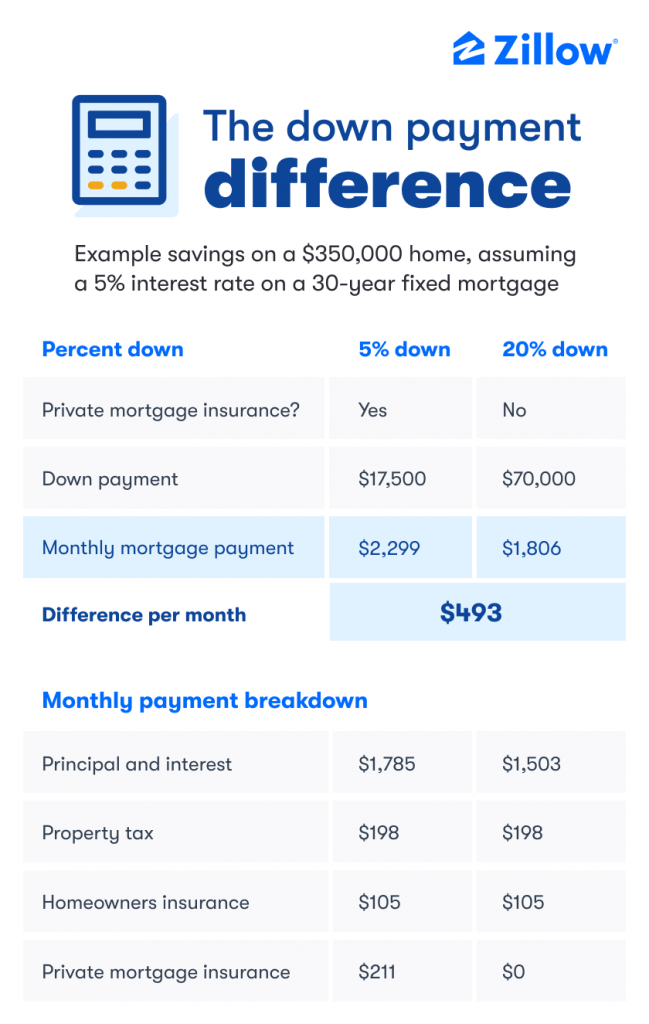

How Much Is A Down Payment On A House Zillow

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

How To Read A Monthly Mortgage Statement Lendingtree

Family Loan Agreements Lending Money To Family Friends

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

Pin On Mortgage Madness

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing